Data Delivery Solutions

Real-Time Market Data Delivery

Options Analytics Delivery

Historical Data Delivery

Consult With Us

Real-Time and Historical Data Delivery

Effective analytical workflows are a critical component of trade strategy development. Our SpiderRock data delivery solutions combine institutional quality market data and analytics with resource-efficient delivery.

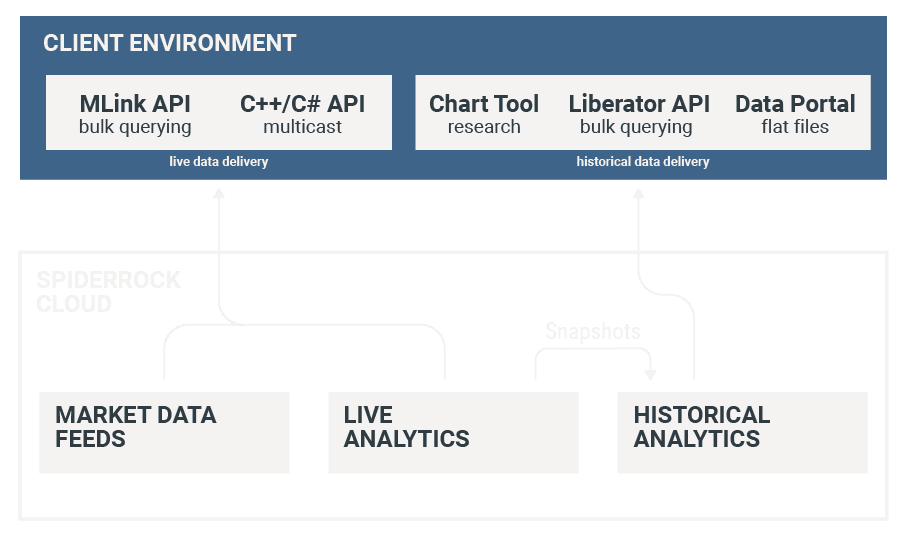

Overview

Our analytics framework provides a low latency and scalable solution for clients to consume live and historical data. Below is a representation of our features and delivery mechanisms.

Market Data Feeds

Vendor of record

Low latency Raw / Normalized

- US-listed equities

- US-listed options

- US-listed futures

- Quotes & prints

Live Analytics

- Greeks

- Implied volatilities

- Volatility surfaces

- Historical volatilities

- Risk Factors

- Trade performance

- Opening/Closing marks

Historical Analytics

Snapshots of

live data/analytics:

- End-of-day

- Intraday

- Minute bar

- Previous day

- Up to 10 years

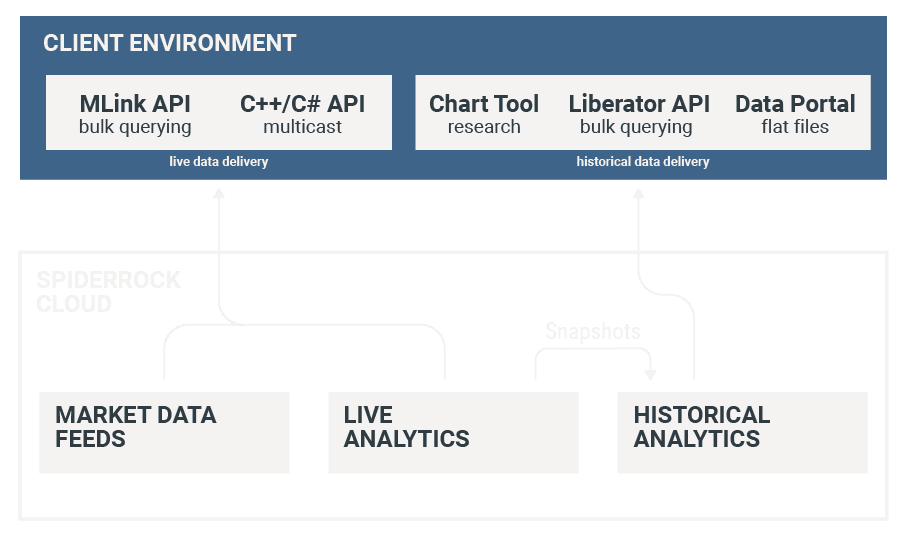

Overview

Our analytics framework provides a low latency and scalable solution for clients to consume live and historical data. Below is a representation of our features and delivery mechanisms.

Market Data Feeds

Vendor of record

Low latency Raw / Normalized

- US-listed equities

- US-listed options

- US-listed futures

- Quotes & prints

Live Analytics

- Greeks

- Implied volatilities

- Volatility surfaces

- Alpha probabilities

- TCA metrics

- Risk / PnL attribution

- User theoretical models

Historical Analytics

Snapshots of

live data/analytics:

- End-of-day

- Intraday

- Minute bar

- Previous day

- Up to 10 years

Real-Time Market Data Feed Delivery

We provide raw and normalized low latency multicast feeds covering US equities, options, and futures markets, as well as highly specialized analytics feeds containing option analytics and implied volatility.

Exchange Feed Connectivity or Normalized Data Services

Raw data is delivered from its original exchange source in real-time. For normalized feeds, we offer a client-side API suitable for turning multicast packets into individual message events for any of our exchange market data feeds. This API is optimized for the efficient processing of very high packet volumes and very low latencies. This API is currently available in C++ and C# versions.

Low Latency Service

Exchange feed pre-processing converting native protocol into a single binary format is done via a combination of FPGA and kernel bypass technology to deliver fast normalized data feeds.

SpiderRock uses Arista switches and a mix of 10GB and 40GB fiber connections to deliver low latency data feed products for institutions, other vendors, and professional trading firms.

Hosted Solution

Our data service is hosted within the NY4/5 and CH2 data centers. Clients can consume data feeds in their environment using their feed handlers or using SpiderRock supplied C++ / C# APIs. Alternatively, clients can host their software on SpiderRock-owned hardware and access it via remote display technology for a cost-effective, managed solution.

SpiderRock supports all popular infrastructure technologies and support connecting your equipment directly to the exchange to achieve low latency execution.

SpiderRock Proprietary Live Analytics Delivery

Our proprietary live analytics offer low-cost delivery of market data and options analytics without our clients making a significant investment in infrastructure. The analytics for volatility and surface modeling accuracy is capable of supporting live trading operations.

Volatility and Greeks Feed

The volatility and Greeks is a reliable real-time feed for all US-listed options (equities and futures). It provides options and underlying NBBO prices, bid/ask implied volatilities, SpiderRock implied surface volatilities, and Greeks, as well as proprietary analytics. This empowers clients to implement enterprise trading and risk solutions without making a significant investment in handling options data and calculations.

Analytics are distributed as messages in multicast format via our C++/C# API or displayed via query on our MLink API. All analytics are delivered through a robust and reliable technical infrastructure targeted to support traders and trading platforms with live, delayed, or query data.

Normalized OPRA Feed

We offer a normalized version of the OPRA feed that can be processed on a single thread of a single core on a current-generation machine, reducing the infrastructure required. This feed includes the two top price levels and sizes and a bitmask describing the participating exchanges.

SpiderRock’s normalization process of OPRA feed reduces bandwidth profile that is more manageable for firms who need real-time options data. Our feed is typically 1/10 the size of the OPRA feed. The normalization is accomplished by immediately publishing prints and NBBO price level changes and holding back changes related to size only. More than 90% of the actual OPRA quote messages are size-only changes which are generally not as time-sensitive in typical end application use cases.

Historical Data Delivery and Delivery Options

SpiderRock provides a wide variety of historical data in multiple file formats with frequency from end-of-day to one-minute intervals throughout the trading day. This data is stored in our cloud-based infrastructure as individual daily files for easy access and database construction or as part of SpiderRock time-series database for direct client access through our Liberator API.

Cloud-based file delivery

Data tables are organized for customer access by format type (closing marks, minute bars, surfaces, prints) and loaded into cloud-based storage overnight partitioned by date. This primary copy of daily subscription files is accessible to clients for daily downloads. Bulk download of large historical data tables is also available.

Clients can access both daily and bulk files manually by download via a browser or programmatically using the public-facing IP and security token provide provided by SpiderRock when an account is opened, or samples requested.

SpiderRock Liberator – Historical Data API

Our new Liberator API allows a user to select data points by ticker or groups and by date and time ranges for direct use within applications. Our API comes with starter codes and notebooks for different languages (python, R, C++, C#, JavaScript) and a Microsoft Excel plug-in.

Using the API reduces the need to download and store large datasets during your research process and allows you to focus your efforts on performing the analysis. Through our Liberator API, you can access SpiderRock options, stock, and futures data within your application using our cloud compute power and pre-optimized query access.

Technology provided by

Volatility Chart Tool

Powerful research and analysis tool leveraging 10+ year history of volatility on popular US Stocks, Indexs, ETF, and ADRs. Simple and intuitive charts for efficent implied and realized volatility research and analysis.

Data Portal

Customers can log in and view historical data files that they have subscribed to using our new Data Portal. Search, filter, and download data from SpiderRock through online access.

Consult With Us

Our broad and rich analytics are easily accessible via multiple delivery mechanisms. This empowers you to scale while keeping cost under control.

Consult with our team of experts to explore the SpiderRock data & analytics offering.