FIX GATEWAYS

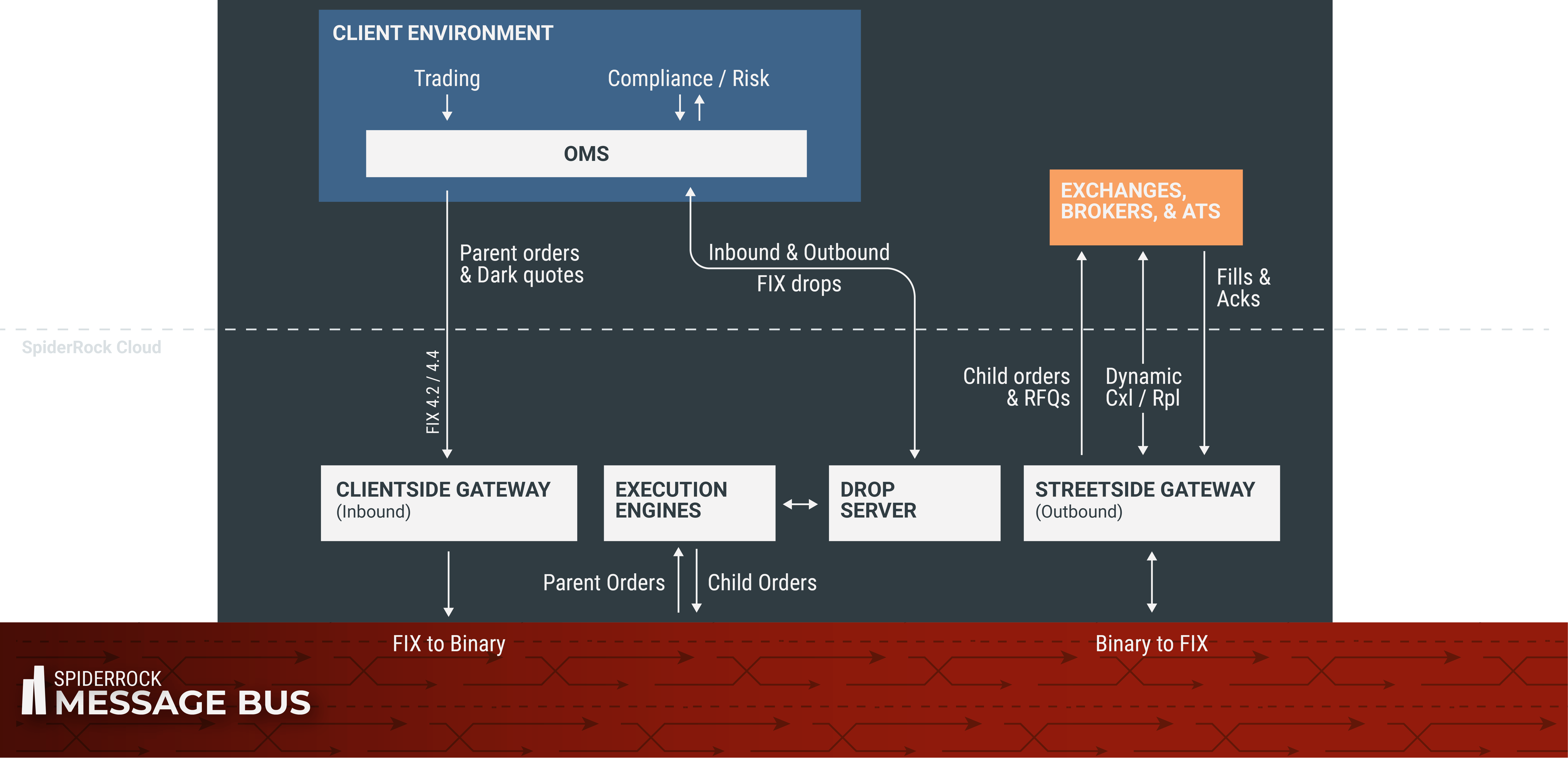

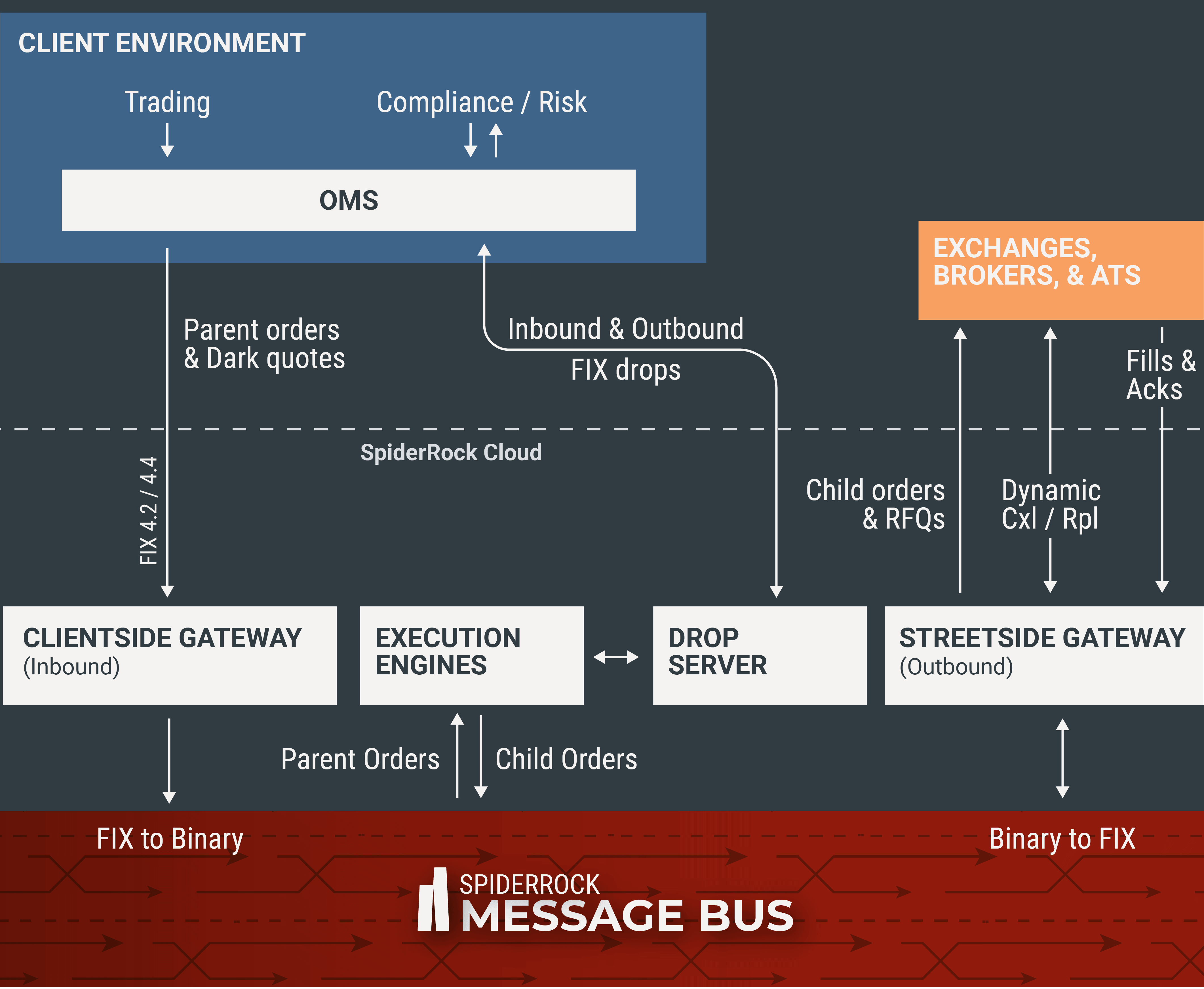

Our FIX infrastructure is a low-latency, high throughput hub supporting end-to-end order entry, order management and execution via multiple brokers/exchanges, third party integration, and access to private liquidity.

This FIX infrastructure is comprised of both client-side and street-side gateways, collectively called FIXBase. FIXBase is an innovative, proprietary binary FIX technology for fast translation of messages.

Overview

Below is an overview of the main functions supported by FIXBase, including order entry, order management, order execution, as well as drop copy management and third party integrations.

FEATURES

Our binary FIX infrastructure creates a hub for clients to optimize their order execution via routing algos, access private liquidity to enhance price discovery, and access multiple brokers/exchanges.

MARKET CONNECTOR

Inbound Order Entry

Our Client-side gateway enables clients to programmatically submit and manage single & multi-leg orders with access to all routing algos on our system. FIXBase supports FIX 4.2 & 4.4 protocols.

Drop Copy Management

Our drop server manages outbound drops for real-time or

end-of-day order details. The drop server also supports live inbound drops for trades done away, providing a consolidated view of risk.

Broker Agnostic

Our Street-side gateway sends child orders on a DMA basis out to multiple brokers as well as different exchange gateways (Ex: CME, CDW, & MSGW). This allows clients much flexibility in leveraging multiple brokers for execution and maintaining existing relationships.

LIQUIDITY & TRADE OPTIMIZATION

Liquidity Posting

Our Street-side gateway supports dynamic posting of liquidity and optimizes the allowed throughput allowed by an exchange. Additionally, we support mass quoting on the CME Group to enhance liquidity posting.

Dynamic Cancel / Replace

Our high throughput cancel/replace functionality has been extended to our Street-side gateway to optimize the response time to child order activity.

Private Liquidity

Clients can send SpiderRock tradable or indicative dark quotes via FIXBase to interact with existing resting orders, other dark quotes, or auction messages. This increases liquidity participation between the bid/ask spread ahead of exchanges.

Request For Quote (RFQ)

Our clients have the ability to initiate a request for quote for single or multi-leg orders, that may interact with exchange participants, SpiderRock clients, or SpiderRock dark liquidity providers.

Consult With Us

FIXBase provides liquidity enhancement and allows a full integration between your environment, the SpiderRock platform, and the market.

Give us a call to see how FIXBase can enhance your market interaction.