Historical Futures Data

Market Data Products

Consult With Us

Historical Futures Price Datasets

Our historical futures data comes from the live data and analytics that powers the SpiderRock trading system and ensures high accuracy and consistency. Clients can focus on developing powerful strategies by leveraging our historical data and analytics.

What Are Futures and Options on Futures?

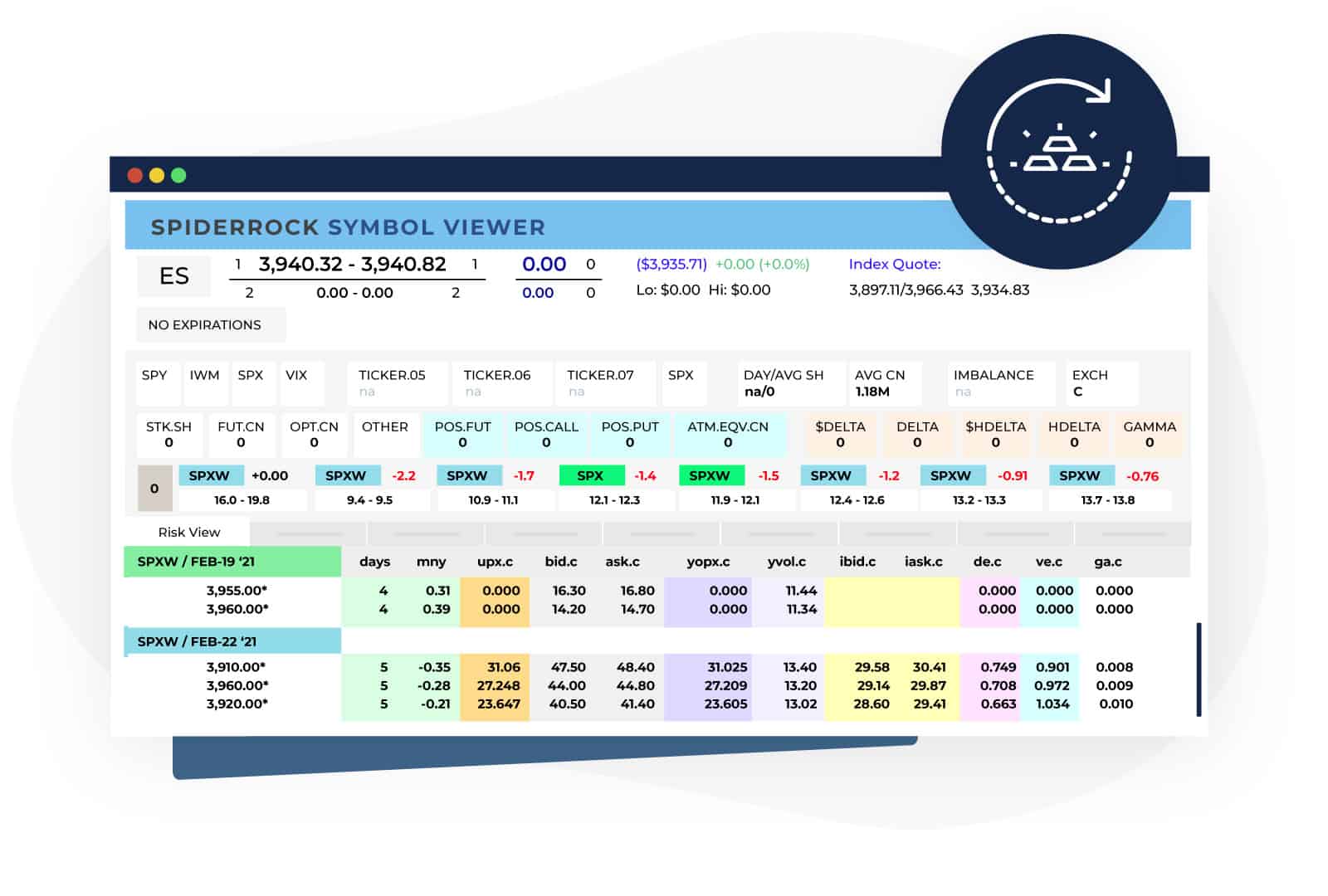

SpiderRock provides historical data feeds that include quotes, volume, and market size for each traded asset. Historical price feeds consist of archived records of the previous days’ trading in different formats and are delivered overnight to clients. The various formats are used to support different use cases or research needs. SpiderRock provides three formats for futures markets for both the underlying security and futures options: Closing Marks, Minute Bars, and Print Sets.

About Our Historical Futures Price Data

Futures Closing Marks

Created immediately after the market closes when the exchanges publish official marks and at the top of the daily rotation. SpiderRock creates and broadcasts a closing mark record for both Futures and Options on Futures. The file is comprised of a unique set of over 30 data fields including the SpiderRock closing mark. Data featured includes:

- Closing quotes

- Closing prices

- Closing underlier bid

- Options bid, ask, and marks

- Option implied bid/ask volatilities

- Greeks

- Theoretical surface prices and volatilities

Prior day closing quotes and prices are included. SpiderRock’s proprietary approach selects the most appropriate closing price for the given security type.

Options on Futures Quote Intervals Records

Options on Futures intraday records are created every 5 minutes while markets are open. They contain the call and put prices and sizes, as well as the underlying stock price for each outright options strike.

They also contain SpiderRock fitted surface implied volatilities and Greeks.

Supported Futures

SpiderRock datasets and feeds include equity index products from the CME, CFE, and CBOE.

- Index Products – Top indexes by volume, including S&P 500, Dow, VIX, Nasdaq, and Russell traded on CME and CFE. Datasets also include broad-based ETFs and other volatility index products.

SpiderRock can also offer other historical commodities datasets from NYMEX, COMEX, CBOT.

- Energy products – Top 20 traded futures and futures spread for oil, natural gas, refined products primality traded on NYMEX

- Treasuries – Top 20 treasuries futures and futures options Including T-bill, and Treasury Bonds (5, 10, 30 year), and various spread products traded on CBOT

- Metals –Top Gold, Silver, and other commercial or precious metals traded on COMEX

- Agricultural products – Wheat, Corn, Soybeans traded on the CME and CBOT

Minute Bars

Future minute bar records contain open, high, low, close, vwap, volume, and other price-related data for all futures and options on futures based on SpiderRock live market data streams.

Bars for options on futures are created every 1 minute and contain open/high/low/close volatility at-the-money for each expiration.

Print Sets

Print set records contain every print along with quotes, surface, and SpiderRock trade details at print time.

These records are created for every print at the time of print and are published 10 minutes later when T + 10M forward marks are available to evaluate trade performance.

Product Offering

US Futures Indexes, ETF, Index Options

Other SpiderRock Data Products

We also offer multiple historical and real-time price datasets including options, volatility, and futures data.

FAQs About Our Historical Futures Data

How far back does your historical futures data go?

SpiderRock’s data history starts in January of 2019 for most of our futures products.

How do you track and collect your futures data?

Our historical data comes from the live data and analytics that powers the SpiderRock trading system. Using the data as part of the trading platform continuously helps to ensure a high level of accuracy and consistency. The data is also properly labeled, saved in a point-in-time format and basic data cleaning is performed to improve quality. SpiderRock evaluates the data for validity and accuracy and performs statistical checks on the production databases daily to verify completeness.

What supporting files come with your futures price data?

Futures and options on futures data comes with a set of reference files that define the details of futures contracts and the linkage between the options and the underlying price. Futures tick sizes and the delivery of the futures vary widely from product to product. Unlike equity options, options on futures may have a more complex underlying asset definition as determined by the exchange listing the product.

Which futures and commodities do you track?

SpiderRock datasets currently cover all futures products from the CME, NYMEX, COMEX, CBOT, and CBOE’s CFE exchanges. SpiderRock is working with other futures exchanges in the US and Europe to add additional products in the near future.

Consult With Us

Please send your data and analytics inquiries to the SpiderRock data team via the contact form below.