Develop your strategy

using our intuitive volatility charts

Pricing >>

Questions >>

Chart Tool Tutorials

Identifying Relative Volatility Opportunities in Equity Options

For traders seeking a more...

Trading Earnings Using Volatility Data

Options trading can be complex, but...

Trading with Implied & Realized Volatility Data

Navigating the complex landscape of...

Key Differentiators

Volatility surfaces from live market analytics

Easy to use interface

10+ years of volatility data on US Stocks, Indices, ETF, and ADRs

Available add-on datasets

Use Cases

Identify opportunities, optimize strategies

Download and share volatility data

Identify market trends

Support market research

What is the SpiderRock Chart Tool?

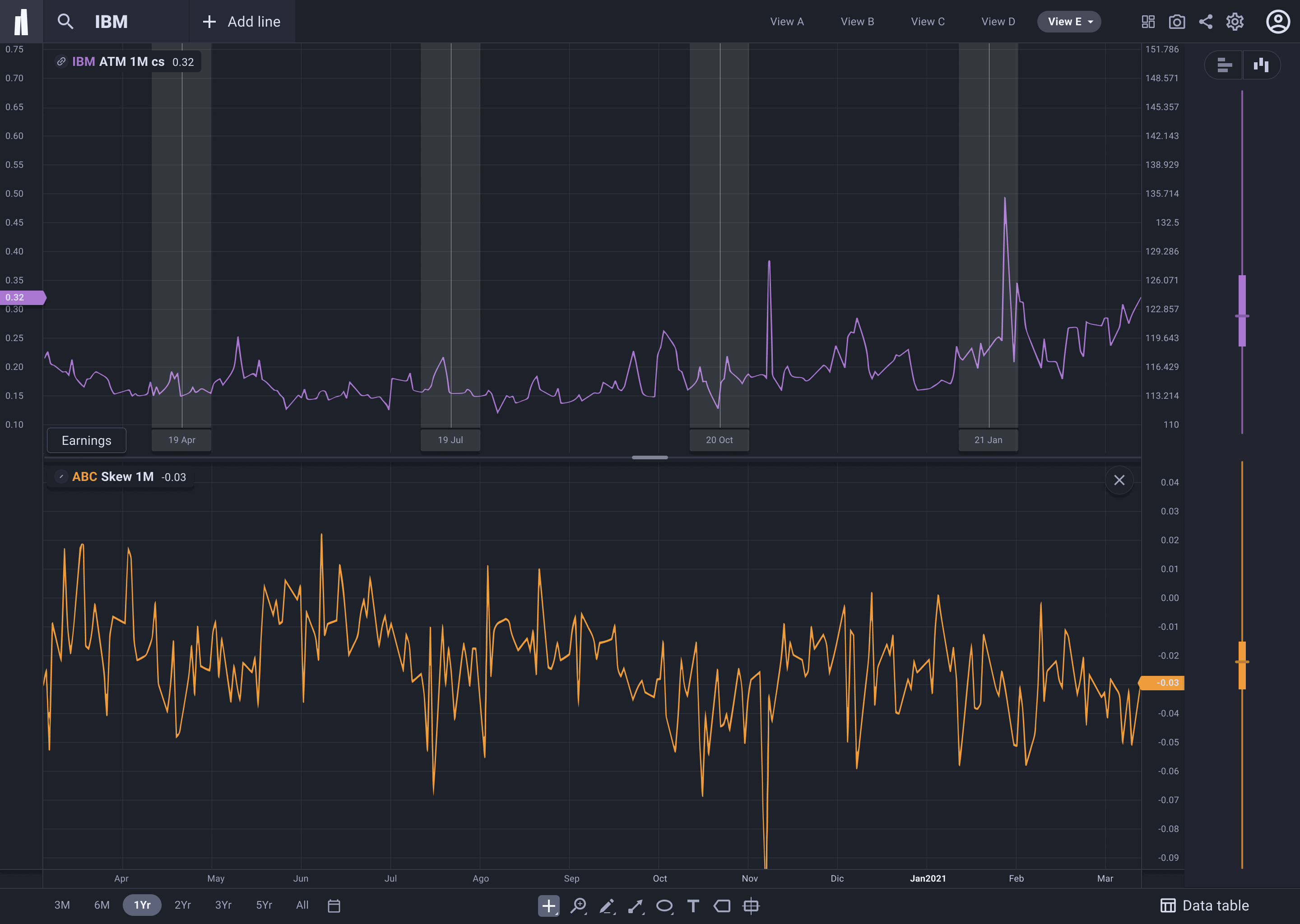

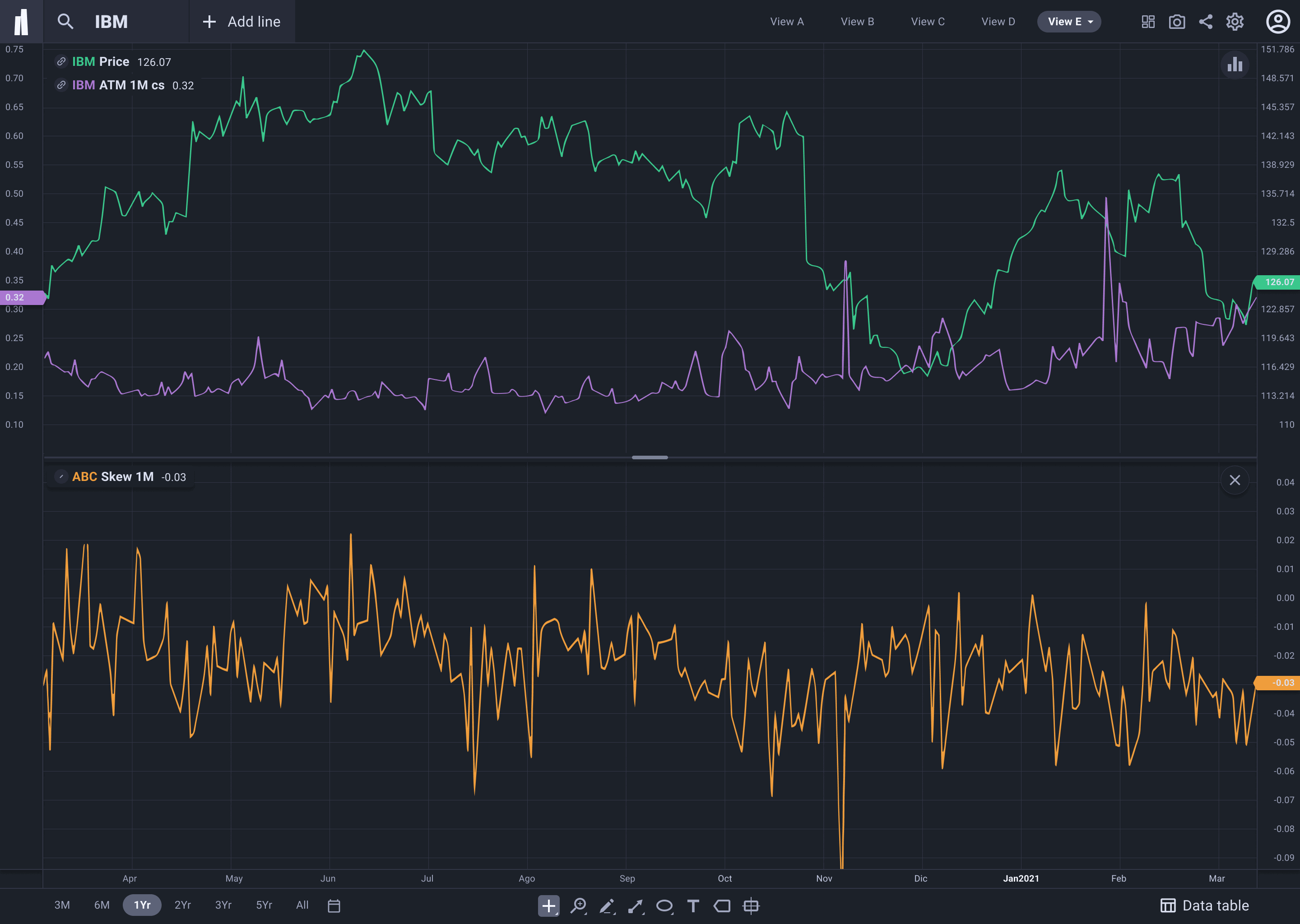

Our Chart Tool enables users to visualize options surfaces and compare relative volatilities between stocks by creating simple and more complex spreads or ratios. Users can quickly analyze the impact of earnings and options skew on implied and historical volatility across stocks, ETFs, and indices using our multi-year database of point-in-time option surfaces.

This allows users to quickly develop, save and share multiple charts to collaborate with their peers. The data is also easily downloaded for further analysis.

Robust Data

- 10+ year history of volatility on popular US Stocks, Indices, ETF, and ADRs. Updated daily

- Access unparalleled history of censored volatility that eliminates earnings seasonality effects enabling better analysis

- Access to wide range of additional SpiderRock data generated from the same live market feeds (subscription required)

Powerful Analysis

- Analyze single stock volatility and skews over time synchronized with moves in stock price and volume flows

- Compare volatility between singles stock pairs or with Index and ETF to build smart trading strategies

- Design custom spreads, ratios, and pairs to analyze trends over time to find and track hidden opportunities

- Visualize earnings event-based stock option volatility with skew, stock price action, and volume

Easily Collaborate

- Share your insights with others, annotate charts, add tags and text

- Save your work in multiple studies at a point in time or have it update daily with new data

- Download your studies or simple base data as needed for further analysis

Research and Compare Datasets

Choose from a selection of available data

- At-the-money implied volatility from 1 week to 2 years

- Realized volatility

- Volatility skew, short-term and long-term

- Stock Price and Stock Volume

- Overlay Earnings events

- 3 months to 10 years

- Zoom in on specific events and scroll across time easily

- Explore different views such as earnings or histogram plots

- Stock Price and Stock Volume

- Build charts that update daily

Compare your analysis and develop studies

- Analyze a single stock or compare multiple stocks

- Analyze pairs and spreads

- Build custom comparisons

- Discover trading opportunities

Highlight, Save, and Share Your Work

- Save up to five views or studies

- Share your work with other users

- Annotate your work with drawing symbols, adding tags or text

Download your data

- View your charts in tabular format

- Download your data to Spreadsheets and Files

- Create custom datasets you can take away and analyze

Pricing

Free Trial

Free

30 days

Access Trader features

for 30 days

Discover all you can

do with Chart Tool

and find new trade

opportunities

Basic

$9.99

per month

Get a Basic package and

leverage these key features

- 2 years of history

- Scope: All US equities

- Equity Prices, Volumes

- Option ATM, Volatility

- Stock Earnings Event Dates/Moves

- Analytics Dashboard

- Share work

- Save 10 Chart Views

Trader

$59.99

per month

Get a Vol Trader package and

leverage advanced features

- 10+ years of history

- Scope: All US equities

- Equity Prices, Volumes

- Option ATM, Volatility

- Stock Earnings Event Dates/Moves

- Analytics Dashboard

- Share work

- Save 10 Chart Views

- Skew

- Call/Put Volume, Open Interest

- Spreads and ratios

- Pair Analysis

- Download underlying data

Other SpiderRock Data Products

We also offer multiple historical and real-time price datasets including options, volatility, and futures data.

30-DAY FREE TRIAL

Gain full access for 30 days and see how easy it is to develop strategies using our data tools.

Questions?