MARKETS

EVOLVE

Stay Competitive With Our

Trading Platform

Trading Platform

SpiderRock has developed a large scale, high message rate core services trading and risk platform that is currently in its seventh generation. This platform operates at market scale and integrates all clients and all markets into a single high-performance system comprised of dozens of machines, thousands of active cores, and very low latency data transport.

The SpiderRock platform can be lightly or highly integrated into client systems as necessary, and functions as a core execution engine and data source for both direct institutional clients (principals) as well as broker clients (agents).

This platform allows clients to access and source liquidity intelligently in listed equities, options and futures markets and supports active managed derivatives strategies with positions in hundreds or thousands of underliers build and maintained by teams of traders, risk managers, and compliance supervisors. SpiderRock provides the market data, idea generation, risk management, and execution services that make up the core system for clients deploying large money allocations in these strategies.

Systematic Dispersion Arbitrage

Portfolio Managers can easily manage such strategies using the SpiderRock system. They typically leverage our APIs to access live market data and analytics, check their real-time risk and insert risk constrained basket of orders decorated with algo parameters to define the execution styles across many different symbols/strikes as well as auto-hedging instructions.

Systematic Long / Short Valuation Arbitrage

Long/Short valuation arbitrage strategies typically attempt to maintain a (roughly) balanced portfolio of long single name volatility and short single name volatility. Portfolios can consist of any number of individual names and may or may not contain index and ETF positions. These strategies usually attempt to build and maintain portfolios with high theoretical edge to historically based theoretical valuation models. This type of strategy typically attempts to dynamic hedge long and short positions as the underlying prices change

Similar to dispersion, portfolio managers can easily manage such strategies using the SpiderRock system. They typically leverage our APIs to access live market data and analytics, check their real-time risk and insert risk constrained basket of orders decorated with algo parameters to define the execution styles across many different symbols/strikes as well as auto-hedging instructions.

Research / Special Situations Trading

In addition, traders can upload their own theoretical valuation models which can include full expiration skew curves or can consist of client supplied ATM valuations only and utilize SpiderRock implied volatility surfaces adjusted to client ATM levels. These theoretical values can then be used to scan the market for ideas and are well integrated into SpiderRock risk and position records. They also can be used to compute hedge deltas that include assumptions about surface dynamic.

Coming Soon

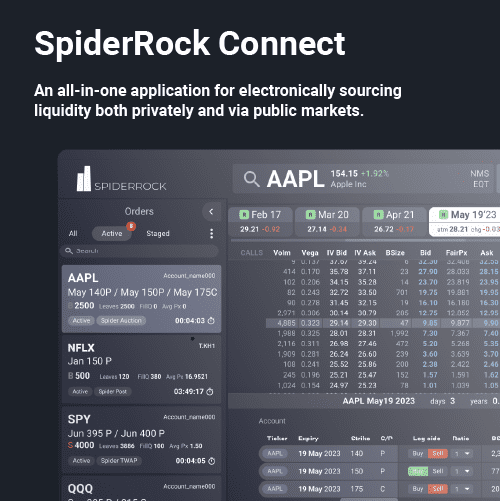

Learn more about SpiderRock Connect

SpiderRock Connect is a NEW web-based trading application that combines SpiderRock’s market leading option algorithms and proprietary analytics with an innovative all-electronic auction capability that connects institutional customers with liquidity providers. Through thoughtful design and attention to workflow SpiderRock Connect integrates price guidance with the ability to execute orders by selecting from a suite of algorithms or initiating an electronic auction from the same execution window.

The NEW SpiderRock Connect auction trading capability automates the way option traders access off-screen liquidity via an all- electronic process. Clients can choose between a standard timed auction or a flash auction, both of which leverage SpiderRock’s extensive liquidity network.

Timed auctions are designed to be customizable and interactive, and provide transparency in the price discovering process. These auctions bring needed innovation to the traditional RFQ process, helping reduce reliance on high touch manual trading. Key to these auctions is the ability to customize counterparties by selecting from a combination of established trading partners and/or the SpiderRock liquidity network.

Core Functionalities

Routing Algos

Our quantitative approach enables you to actively participate in price discovery by leaning on real-time fair values calculation. In addition, our machine learning framework enables our system to continually monitor and take advantage of market micro-dynamic shifts, allowing for precise order routing based on a user-defined level of aggression. This has proven to be an effective method to systematize and scale the execution of a derivatives strategy.

Learn More

Risk Management

Our risk management system ensures a strong cohesion between high velocity trading and live risk calculations at the order level as well as risk aggregation at the portfolio level. This gives you the ability to shape your portfolio in real-time, based on market conditions as well as trading objectives.

Learn More

ANALYTICS FRAMEWORK

The platform is powered by live market data taken from the source and normalized internally. The system computes analytics in real-time which drives our risk management system as well as our proprietary algorithmic routing techniques. All live data and analytics are visible on our GUI Tools and accessible programmatically via SRSE.

Learn More

Compliance Layer

Compliance is a critical component of institutional trading. The platform offers an elegant solution allowing for efficient integration of your evolving compliance requirements via GUI tools or SRSE. The platform is SOC-II compliant.

Learn More

Integration

GUI Tools

Our front-end is comprised of several GUI tools enabling single order entry and basket trading via algorithmic parameters, order management, portfolio risk management, dynamic hedging, and viewing live data & analytics. Our GUI tools are currently delivered via Citrix.

SRSE

Our custom storage engine, SRSE is comprised of 8 MySQL live databases and enables bulk querying and inserting actions to interact with the core system. This API is largely used by our clients to integrate programmatically with SpiderRock for trading, risk, data and compliance.

FIX Gateways

SpiderRock operates a client facing FIX gateway enabling order entry; all algo parameters are supported via FIX. Our street facing FIX gateway connects to exchanges, executing brokers and other client systems/OMS via drop copies to facilitate compliance and risk requirements.

Consult With Our Experts

Behind any great technology is a team of experts.

Let us help you consider whether SpiderRock is a good fit in bringing your team to the next chapter of its technology evolution.