RISK MANAGEMENT

We take a more holistic and dynamic approach to risk management.

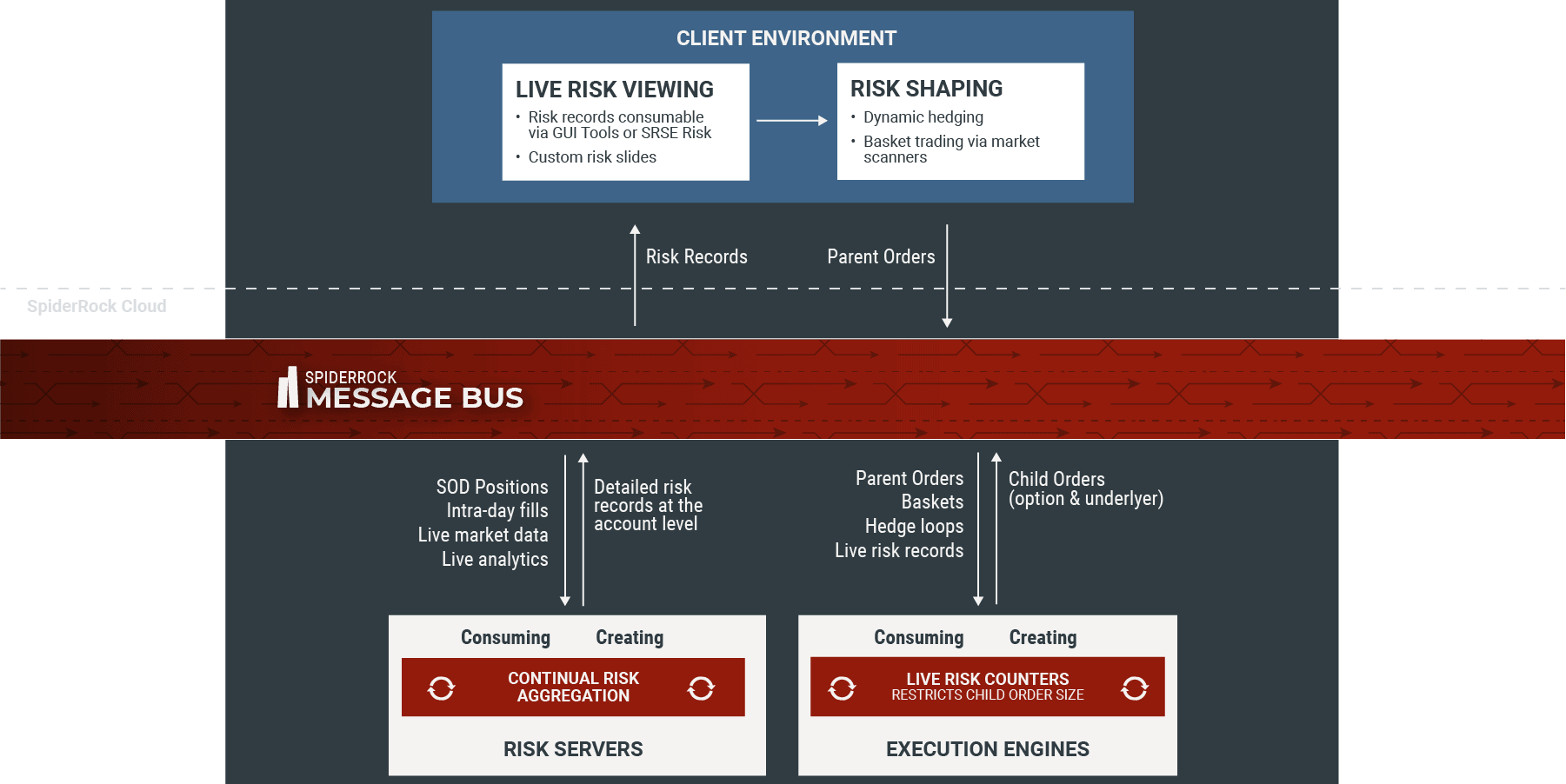

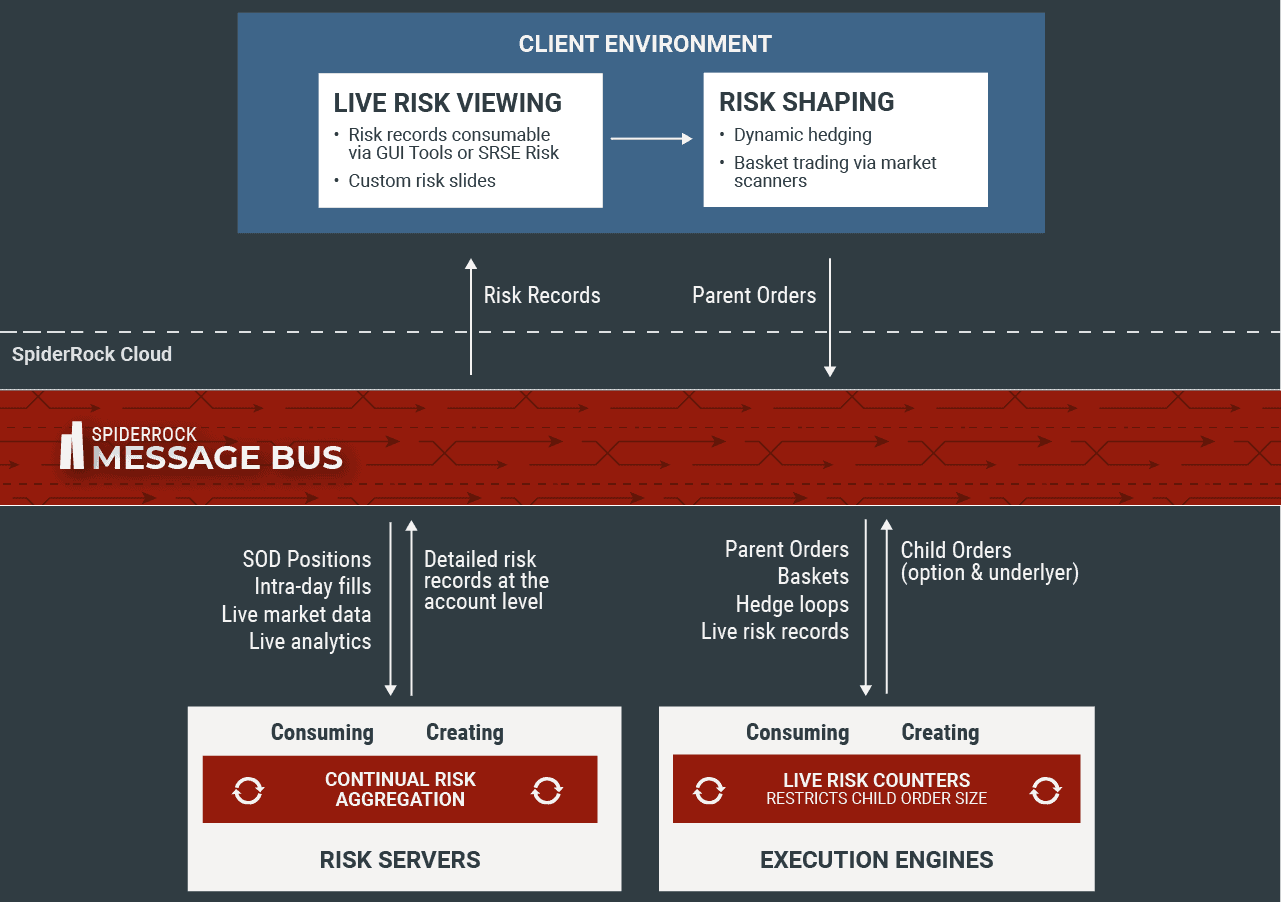

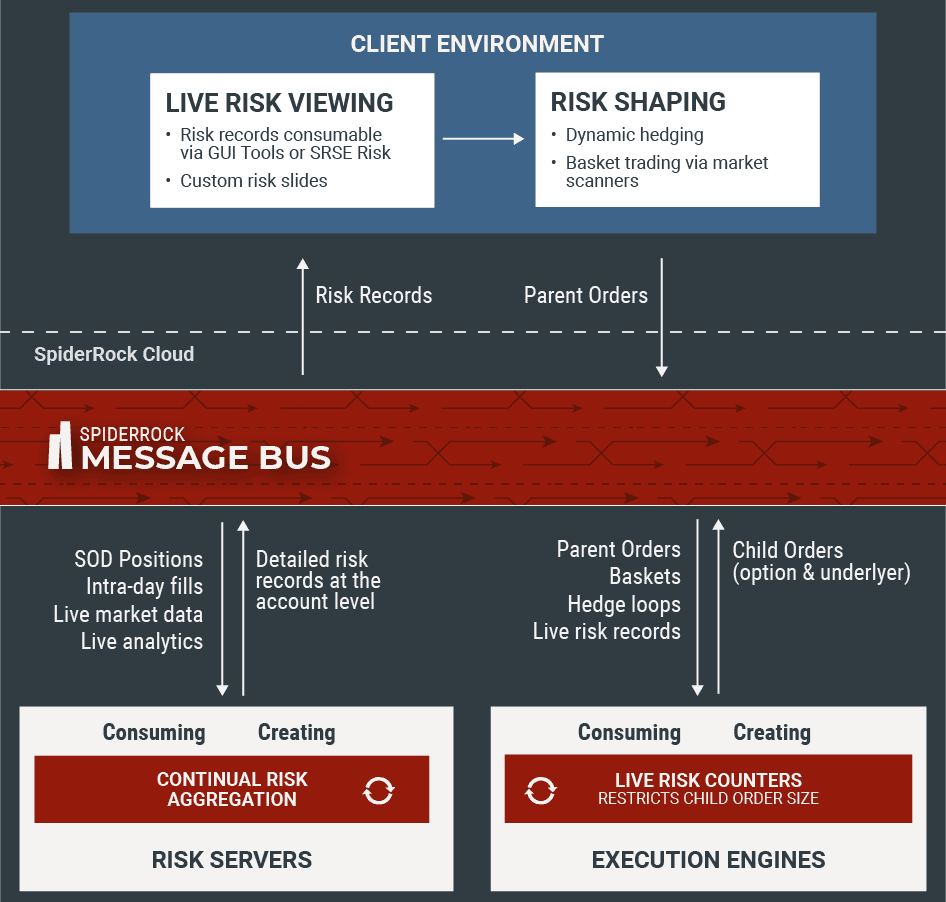

At SpiderRock, the calculation and aggregation of live risk directly affects order creation and trading activity. This design enables our clients to focus more on portfolio risk management rather than managing orders individually. They can shape their porfolio in real-time, based on market conditions and trading objectives.

Overview

Our Risk Servers work seamlessly with our Execution Engines. This integration between risk and trading allows clients to automate and scale the implementation of their strategies efficiently. Below is a representation of the dynamic relationship of our framework.

FEATURES

Our framework allows clients to set risk rules at the order-level and portfolio-level, ensuring tight management of a systematic strategy.

ORDER RISK MANAGEMENT

Risk Group Limits

Clients can define risk group limits that constrain the execution of orders with the objective of working towards a defined target. Risk group limits can be expressed in contracts, vega, premium, $delta, and other custom metrics.

Risk Counters

Risk counters are embedded in our execution engines. They dynamically calculate the net risk (distance between current level and client limit) and can apply to an individual strike or basket of strikes.

PORTFOLIO RISK MANAGEMENT

Risk Record Aggregation

Our risk servers aggregate in realtime start-of-day positions and fills across asset classes, live market data, and live analytics to publish detailed risk records via our GUI Tools and MySQL API (SRSE).

These risk records include, but are not limited to dynamic PnL attribution, hedge delta, greek aggregation, slide risk aggregation, pin risk, and early exercise management.

Risk Management Tools

We’ve created specialized GUI Tools that consume risk records and allow clients to efficiently shape their portfolio. Clients can hedge dynamically and scan the market for risk-increasing or risk-decreasing opportunities.

CONSULT WITH US

Our robust and flexible framework enables you to implement specific and granular risk rules which ensures a risk-constrained execution of their strategy so you can scale effectively.

Contact us to find out more about our unique approach to risk.