ROUTING ALGOS

Our execution engines leverage both quantitative models and well-engineered systems to dynamically represent client interests, enabling active participation in price discovery and precise execution.

SpiderRock offers high-precision making and taking algorithms for all supported asset classes to help clients trade inside public markets and maximize their access to liquidity. With our routing algos, clients can be as aggressive or passive as their strategy dictates – balancing trade velocity and cost of accessing the market.

Asset classes supported: All listed US Equities, Equity/index Options, CFE & CME Group Futures and Options on Futures

Overview

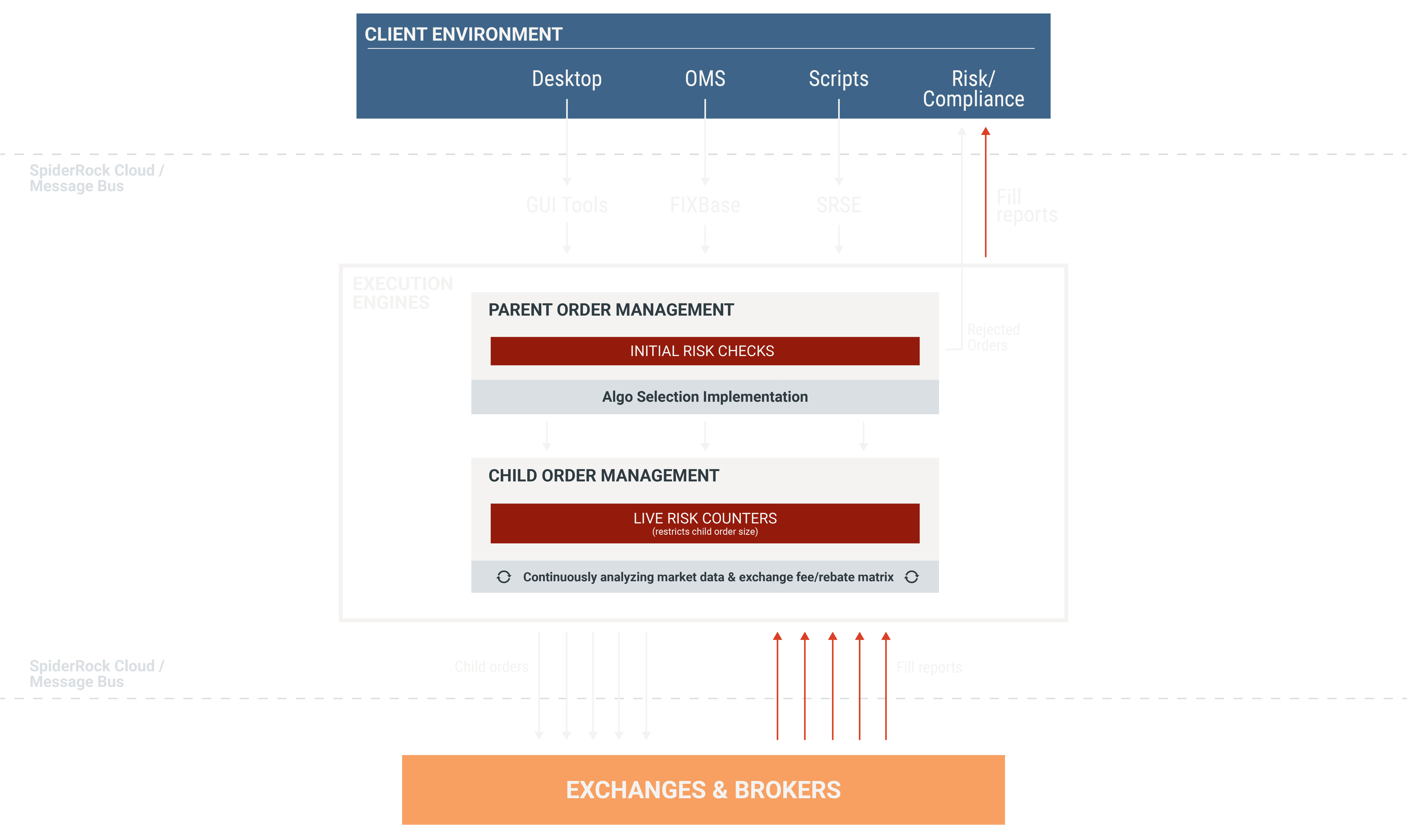

Order entry of simple and complex orders is equally supported via multiple access points making it flexible for clients to interact with our execution engines. Orders are being handled according to clients’ instructions, market conditions as well as a number of risk checks controlling the creation of downstream “child” orders.

features

A well-engineered system that continually monitors and quantifies market micro-dynamics to reliably and precisely execute your strategy.

Quantitative Approach

Volatility Surfaces

Gives clients a live, accurate fair value of an option market. These surfaces are arbitrage-free and can be applied as dynamic limits when making or taking liquidity.

Our fitting process is highly reactive and refreshes several times per second. Surfaces are graphically represented and numerically available via GUI Tools and SRSE allowing clients to download them in real-time.

Alpha Probabilities

For the past ten years, SpiderRock has run machine-learning statistical models to compute our proprietary Alpha Probabilities.

These are real-time numerical estimates of expected short-term profitability of available price points and are measured a few minutes post execution. They are numerically represented via GUI Tools and SRSE and, much like our surfaces, can be leveraged as dynamic limits when making or taking liquidity.

Order Handling

Market Sweeping w/ Smart Routing

We offer automatic time-synchronized sweeping of public exchanges combined with smart order routing.

Advanced Spread Orders

Actively interact with Complex Order Books and/or synthetically with public markets using static or dynamic limits.

Advanced Limit Orders

We offer both single and multi-strike static and dynamic limit orders expressed in delta/volatility with active cxl/rpl.

Response to Auction Mechanisms

Clients can elect to respond electronically to exchange auction mechanisms to enhance their interaction with liquidity pools.

Active Taking

Our Engines continually scan the market for opportunities to trigger client-defined limit conditions.

Dark Quotes

Clients can send dark quotes to our engines electronically to seek a potential match with other clients resting orders.

Active Making

Dynamically size and post child orders based on client-defined limit conditions with active cxl/rpl.

Staging Orders

Staging orders are supported throughout the system so clients can meet their compliance requirements.

Order Sizing

Basket Risk Controls

Orders can be organized into baskets with active risk group limits expressed in vega, premium, dollar delta, contracts or other custom metrics. These risk group limits will constrain the size of child orders based on the net risk as execution of orders occur.

CONSULT WITH US

SpiderRock operates a complex environment for routing equity, options and futures orders. Our experts will consult with you and explain how the SpiderRock system can enhance, scale and optimize your execution experience.

Please contact us to review the different features and routing logic.