Given the current uncertainty-driven market regime, having accurate and granular data is critical. SpiderRock Data & Analytics leverages its comprehensive datasets to decode market complexity and provide insightful observations.

One relevant data set the surface grid is available both intraday and end-of-day (EOD). The data is derived from the SpiderRock volatility surface by first reducing the noise impact of the earning events, then normalizing the surface by representing strikes as the exercise likelihood (Call Delta) and the constant time to expiration.

A typical use case is tracking the grid surface leading into events, in particular earnings. We can identify market trends by comparing current data to historical averages from past earnings. For instance:

How does current data compare to what’s typical around earnings announcements?

Are there noticeable shifts in the value of certain options as we get closer to the earnings date?

Case Study: Tesla’s Implied Volatility

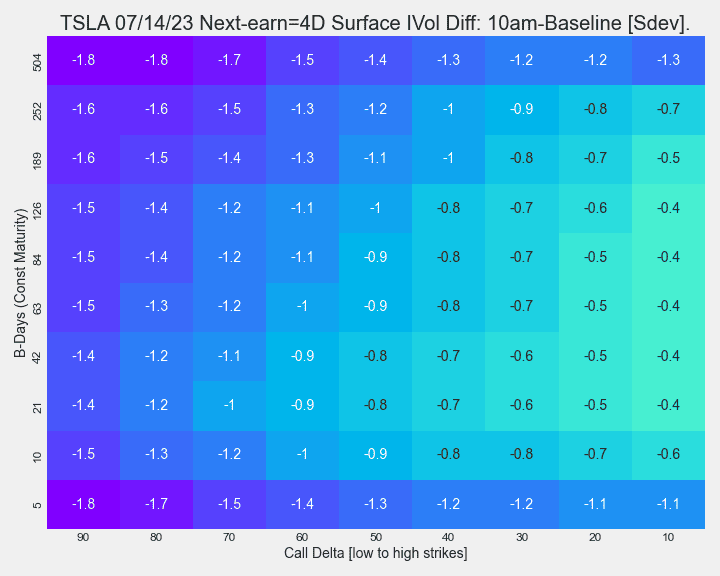

Let’s explore the potential of this data using Tesla (TSLA) options as an example. We are focusing on Tesla’s (TSLA) options four and two days before the earnings announcement on July 19, 2023.

For each strike-expiration sector, we measure the distance in standard deviations between the average implied volatility calculated across the past earnings and the current (as of observation date) value.

Below we illustrate the comparison between the baseline and the intraday grid volatility snapshot taken on 7/14/2023 around 10 a.m:

In the heatmap above, the horizontal axis shows the strike in units of Call Deltas, with 90 Delta being the lowest strike (deep ITM) and 10 Delta the highest far OTM, while the vertical axis shows how long until the option expires. The colors give us a sense of how the current market compares to historical averages.

Qualitatively, negative numbers indicate that the current option value is cheaper than historically, and positive numbers that the current option is more expensive than the past values in the surface sector of interest.

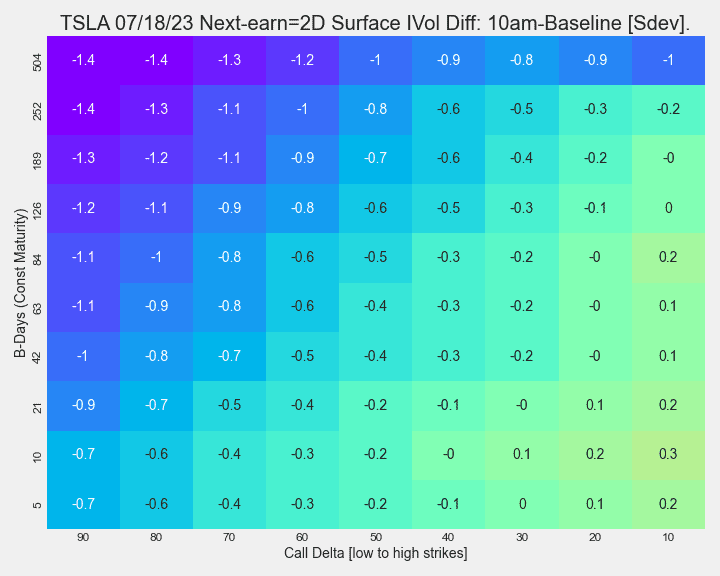

The second heatmap represents the data snapshot taken two days before the earnings day:

Interestingly, as we near the earnings date, certain options become more valuable. This could mean investors are expecting material developments and there is possibly increased buying activity in anticipation of the upcoming earnings event. It’s essential to be cautious and proceed with more quantitative analysis; while there’s a trend, it’s subtle.

Also, options that are more likely to be exercised (those “deep in the money”) and those that have a while before they expire don’t show much change. This could mean investors are holding onto these options, either because of expecting long-term gains or reflecting positions due to previous hedging activities.

By tracking these patterns daily, we ascertain the market outlook about upcoming announcements. This insight is invaluable for building portfolios, spotting market trends, or estimating market risks.

It’s worth noting that the SpiderRock surface grid data undergoes rigorous refinement. Transitory short-term reactions are carefully filtered out to ensure an accurate capture of latent factors in the market trends.

Concluding Thoughts

In short, SpiderRock’s unique grid surface data offers an alternative perspective on the options market. It provides insights that aren’t just based on end-of-day figures, allowing for a dynamic view of the market. With our specialized calibration approach, we ensure that the data is consistent and reliable, regardless of external events.

This SpiderRock grid data is invaluable for various purposes, from analyzing market signals to managing portfolios, and shows great potential in enabling our clients to navigate market complexities and drive strategic decisions with confidence.

About SpiderRock:

SpiderRock Gateway Technologies is the data & analytics division of SpiderRock. SpiderRock Data & Analytics is an exchange-licensed redistributor of market data, providing US stocks, options, and futures market data in a raw and normalized format. Our proprietary live analytics offer low-cost delivery of market data and options analytics without clients making a significant investment in infrastructure.

For more information, please visit spiderrock.net, follow us on Twitter at @SpiderRockChi and visit our LinkedIn Page.

Have any questions?

Fill out the form below and we’ll get back to you as soon as possible.